June of this year, China’s textile and apparel trade $ 27.84 billion, an increase of 6.2%. Among this, exports 25.65 billion U.S. dollars, an increase of 6.5%, imports of $ 2.19 billion, an increase of 3.2% month trade surplus of $ 23.46 billion, an increase of 6.8%. 1 to June, China’s total textile and apparel trade $ 145.47 billion, an increase of 4%. Among this, exports $ 132.5 billion, an increase of 4.1% and imports 12.97 billion U.S. dollars, an increase of 2.9%, the cumulative surplus of $ 119.53 billion, an increase of 4.3%.

Overall analysis

Steady growth in exports during the first half

The second half is expected to stabilize the main

In the first half of this year, the major developed economies showing signs of recovery, the European Union and the United States and other major textile and apparel import market demand gradually pick up. Meanwhile, by the central government introduced a series of measures to promote trade stability, smooth overall performance of textile and apparel trade, imports and exports are to achieve growth rate exceeded the overall level of trade in goods in China. Among them, a quarter of export fluctuations in amplitude of each month, in the second quarter into the stable growth period, the average growth of 7.3% quarter exports.

From the current overall situation, the international market demand remains warmer, plus the steady gradual release of foreign trade policy, the activation of the domestic export enterprises initiative and enthusiasm, confidence export, exports are expected to continue to grow in the second half. However, due to the depth and breadth of the market rebound uncertainty, exchange rate fluctuations yuan frequent business reflects the high cost of production, import and export miscellaneous fees, customs clearance efficiency is not high, financing difficulties and other problems still constrain the pace of rapid export growth . Coupled with the relatively high base last year, is expected in the second half of textile and garment export growth rate will not be too large, steady annual export growth will be the main tone.

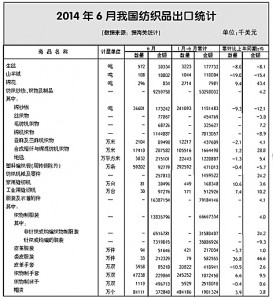

Export profile

General trade to drive growth

Increase in volume and a drop in price of commodities

1 to June, total exports of general trade $ 101.2 billion, an increase of 4.5%, is the major driving force overall export growth, export share further increased to 76.4%; border trade export growth is slowing down compared with last year, the six months increased by only 3.5%, compared with last year’s level dropped 30 percent. Processing trade exports grew 1.1%, mainly feed processing to maintain growth, processing exports fell 9 percent.

The first half of the textile and apparel export pace. Textile exports 53.31 billion U.S. dollars, an increase of 4.2%, apparel exports 79.19 billion U.S. dollars, an increase of 4.1%. Textile yarn exports only fell slightly, fabrics grew 3.8%, manufactured goods grew 6.2%; apparel commodity knitted and woven garments total exports of 16.4 billion (sets), an increase of 8.4%, the average export price fell by 3.6%. With the decline in domestic cotton costs and export prices of cotton yarn to make garments significant decline in cotton yarn export prices fell 9.7%, cotton clothing fell 8.7 percent.

Trading partners

The main strong market position in Europe and America

ASEAN needles, woven garments demand different

The fastest growing exports to the EU

With the gradual warming of the EU economy in the first half of the EU’s export situation is good, total exports $ 26.1 billion, an increase of 18.5 percent, the EU has become our fastest growing major export market. Textile exports to the EU grew 13.4 percent, clothing increased 20.2 percent. Where almost all the major categories of merchandise exports to achieve double-digit growth. Knitted and woven garments total export volume reached 3.77 billion (sets), an increase of 17.3%, the average export price increase of 3.7%.

Exports to the United States to enhance the smooth

In the first half, China’s exports of $ 19.45 billion to the United States to achieve a steady growth of 6.9%. Which grew 5.7 percent textiles, clothing increased 7.4 percent. Knitted garments, woven garments total exports 2.8 billion (sets), an increase of 2.8%, the average export price increase of 4.9%. The EU and the United States the two major traditional markets once again become a major growth point of China’s exports, the share of exports in total exports to the European market from 32.8 percent last year, rose to 34.3 percent, boosting the overall export growth rate reached 15.4 percent.

ASEAN market slowdown

2010 to 2013, the ASEAN 4 consecutive years of the fastest-growing major export markets, export growth of more than 20%. Enter 2014, the growth rate gradually slowed down in the first half cumulative exports to ASEAN $ 16.7 billion, an increase of 3.2%, which grew 10.2 percent of textiles, apparel fell 7 percent. Key export commodities fabric and yarn exports increased 6.6% and 19.1%, respectively, finished up 18%. Clothing knitted and woven garments show different: knitted garment exports fell 13 percent, while woven garments has soared more than three times, including a variety of fabrics made garments were doubled, wool clothing increase even more than 10 times, export destinations are mainly concentrated in countries such as Vietnam, Malaysia, Indonesia and so on. Rapid export growth on the one hand due to ASEAN consumers of cheap clothing products enable increased imports; on the other hand, perhaps with ASEAN through various channels will be re-imported clothing exports to Japan and the European and American market status.

A further decline in exports to Japan

Since 2014, the Japanese market position in a further decline in China’s exports, as in the first half, Japan’s share of exports to less than 9% of total exports. 2 to June exports all declined each month, 1 to June cumulative decline of 8.4%, which decreased 11.1% mainly due to clothing, textiles maintain 3.6% growth. Knitted garments, woven garments total exports fell 8.5 percent, the export price fell by 4%.

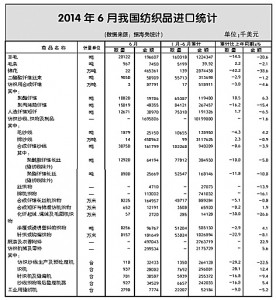

Imported Overview

Apparel fabrics decreased speed up

Cotton spreads continued to narrow

1 to June, China’s textile imports $ 10.2 billion, down 1.6 percent, clothing imports $ 2.76 billion, an increase of 23.4%. Textiles accounted for the major share of the yarn, fabric imports fell by 1.3% and 7.3%, respectively, manufactured goods increased by 9.5%. Cotton prices fell by the impact of the early rapid growth in imports of cotton yarn imports down quickly, imports increased by only 2.3 percent in the first half. Clothing imports was mainly pulled by rapid growth of knitted, woven garments, half knitted and woven garments total imports increased 69 percent, the rapid growth of the country of origin of imported mainly in Korea, Vietnam, Bangladesh and other countries, the average import price decline 25%.

In the first half, China’s cotton imports significant decline, of which the first five months of imports of basic monthly decline trend showing a slight rebound in June, the month of imports 218,000 tons, down 19.1 percent, a decline from the previous month to shrink. 1 to June total imports of 1.395 million tons, down 42.2%. The average import price $ 2,060 / ton, an increase of 6.2%.

June, with the cotton companies to buy cotton is still dominated by the State Reserve and imported cotton, spot prices, but the momentum has slowed down. June, Chinese cotton price index (CC Index 3128B) average price of 17,371 yuan, down 63 yuan. China imported cotton price index FC Index M monthly average 91.99 cents / lb, down 2.83 cents. 1 percent lower tariffs and sliding tax break was 14,469 yuan RMB / ton and 15,644 yuan / ton, respectively, lower than the Chinese cotton price index for the same period in 2902 yuan and 1727 yuan, 353 yuan and expand the post were 230 yuan. The difference between the first half of domestic cotton and imported cotton from last year’s average of 4000 to 5000 yuan down to less than 3,000 yuan.